fanduel w2|Understanding Fanduel Earnings Taxes: Common FAQs Answered : iloilo Please note: W2-G forms / Year End Reports for 2023 will be available following January 31st, 2024. Click on the Account icon in the upper right-hand corner of the TVG website . XVIDEOS bucetas videos, free. XVideos.com - the best free porn videos on internet, 100% free.

fanduel w2,Please note: W2-G forms / Year End Reports for 2023 will be available following January 31st, 2024. Click on the Account icon in the upper right-hand corner of the TVG website .

If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, .

Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non .Please note: W2-G forms / Year End Reports for 2023 will be available following January 31st, 2024. Click on the Account icon in the upper right-hand corner of the TVG website .

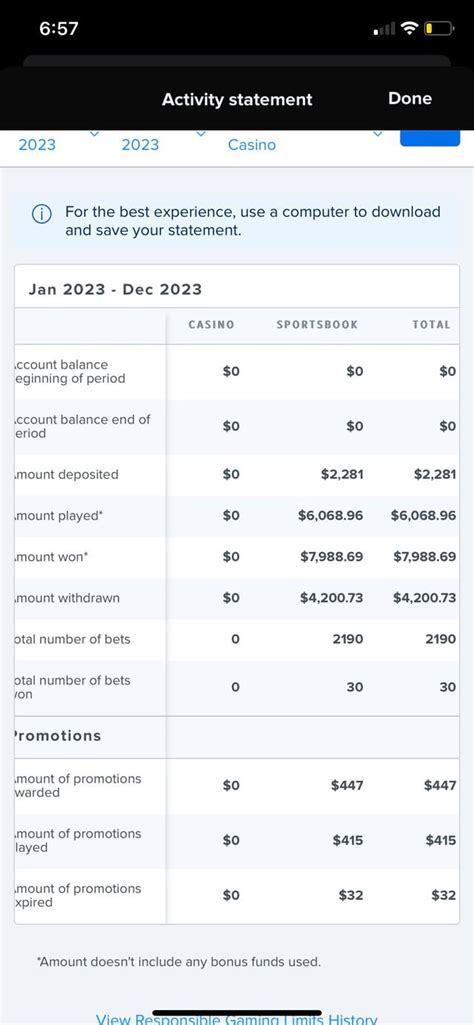

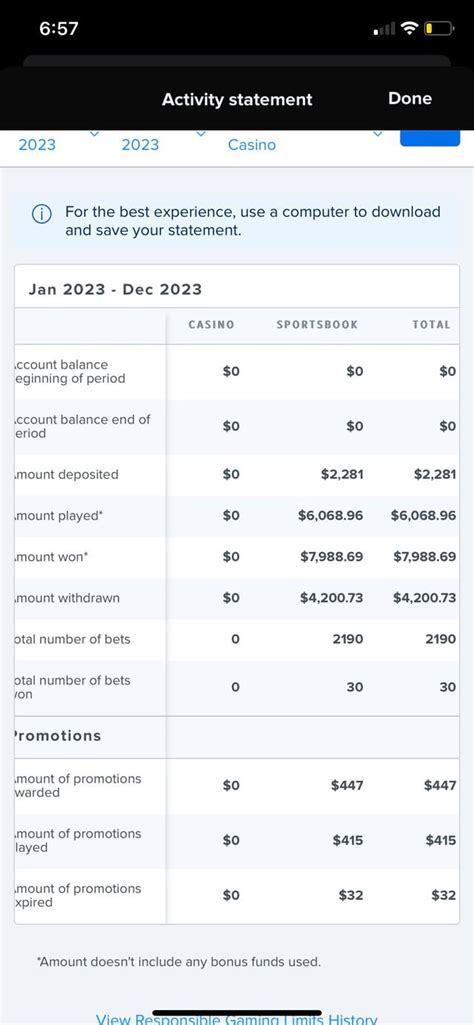

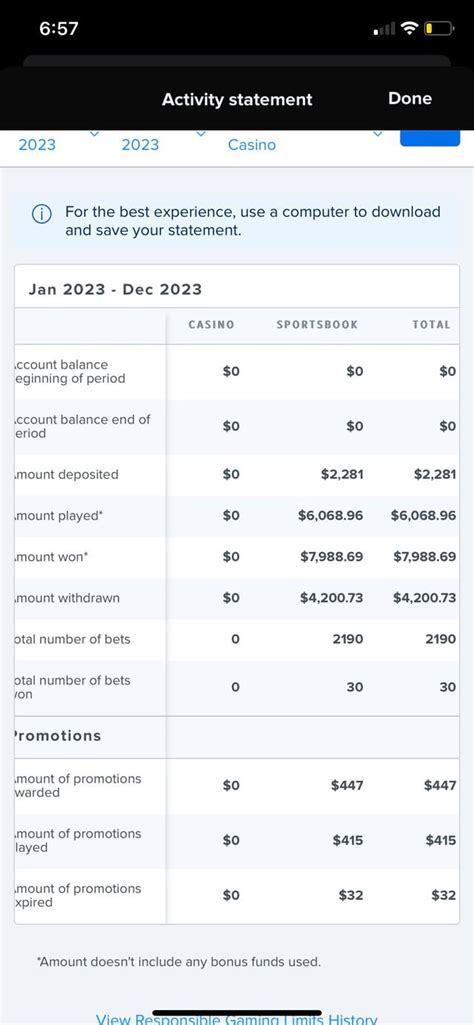

Sometimes the Win/Loss statement is called a Player Activity Statement. This is a view of all the gameplay, bets, transactions, and contests you enter with FanDuel. You can find all things financial across all our .

fanduel w2Sometimes the Win/Loss statement is called a Player Activity Statement. This is a view of all the gameplay, bets, transactions, and contests you enter with FanDuel. You can find all things financial across all our .

Form W-2G is an Internal Revenue Service document that a casino or other gambling establishment sends to customers who had winnings during the prior year that must be reported as income to. FanDuel Sports Betting Taxes Guide: Do I have to pay taxes on my FanDuel winnings? How Much Does FanDuel Tax? Does FanDuel take taxes out .FanDuel is the leader in one-day fantasy sports for money with immediate cash payouts, no commitment and leagues from $1.Question really says it all. Fanduel hasn’t sent me my w2g yet and I was wondering if others have received theirs. Also are they sent just via email?

FanDuel will send you a W2-G form. This is the form used to report gambling winnings. They only send you this form if you meet the criteria. In some cases, you might see the form is blank. Which means .

Please note: W2-G forms / Year End Reports for 2023 will be available following January 31st, 2024. Click on the Account icon in the upper right-hand corner of the TVG website to access the W2-Gs & Year-End Reports. DISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need .

Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.If you receive your winnings through .FanDuel will issue a Form W-2G for each from winning transactions on horse race wagering when both of the following conditions are met: Winnings (reduced by wager) are $600.00 or more; and . TVG - Taxes, W2-Gs & Year End Reports. Number of Views 22.8K. Canada - Desktop browser location troubleshooting. Number of Views 436.With FanDuel Research, you can read up on the latest NFL news, NBA news, MLB news, NHL news, and even College Football news. It's also easy to catch up on all the odds, whether it's NFL Odds, NBA Odds, or College Football Odds. New FanDuel customers Bet $20, GET $150 in Bonus Bets if your Moneyline Bet Wins or a $500 bonus on fantasy .Connect with FanDuel for instant answers, email, and live chat

Sometimes the Win/Loss statement is called a Player Activity Statement. This is a view of all the gameplay, bets, transactions, and contests you enter with FanDuel. You can find all things financial across all our FanDuel products, including how much you have deposited, played and won. You can also customize and view certain months throughout .

fanduel w2 Understanding Fanduel Earnings Taxes: Common FAQs AnsweredBet online with America's best sports betting site, FanDuel Sportsbook. Get live odds on sports and sign up with our latest promos!

Select “Live Chat" at the bottom-right of this screen to get answers from our agents. Send us a DM on Twitter at our support handle @FanDuel_Support , or a private message on Facebook. The team is available from 8:00AM-12:00AM ET every day, and aims to respond to all messages within an hour. If email is your preference, you can also send us . Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non-cash prizes and learn about crucial IRS forms like 1099-MISC and W-2G. Delve into professional insights on the importance of meticulous financial record-keeping and . Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on your . About Form W-2 G, Certain Gambling Winnings. File this form to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on: the type of gambling, the amount of the gambling winnings, and. generally the ratio of the winnings to the wager.

We would like to show you a description here but the site won’t allow us.

If you take home a net profit exceeding $600 for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal, CashApp, Zelle, or Venmo, the reporting form may be a Form 1099-K.You do NOT claim net winnings. I don’t care if “FanDuel’s app says net winnings”. I used Credit Karma to file. In the income section it specifically states “Gambling Winnings (excluding losses)” in the deductions section, it asks for “Gambling Losses”. . W2-g don’t come until feb. you can request a win-loss statement and .

1. Description of Promotion. Welcome to the FanDuel Faceoff $10 Sportsbook Bonus Bet promotion (the “ Promotion ”), where invited participants who enter and complete their first paid contest on their Faceoff Account (as defined below) will receive Ten Dollars ($10) in bonus bets available for use only on FanDuel Sportsbook (“ Sportsbook .WHAT CAN WE HELP YOU WITH? Location Troubleshooting. Log-in & Password. Verification. Locked Account. Close My Account.

Please note: W2-G forms / Year End Reports for 2023 will be available following January 31st, 2024. Click on the Account icon in the upper right-hand corner of the TVG website to access the W2-Gs & Year-End Reports. DISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need .

fanduel w2|Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH0 · Where can I see my Win/Loss or Player Activity

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH2 · Taxes

PH3 · TVG

PH4 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH5 · Log in to FanDuel

PH6 · Has anyone received their 2022 W2G (W

PH7 · Form W

PH8 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings